INVESTMENT MANAGEMENT FOR PEACE OF MIND

A well-defined investment plan gives you the security and confidence that brings peace of mind to you and your family.

Your financial needs and expectations form the core of any comprehensive investment plan. Your investment advisor should be fully dedicated to helping you achieve your current and future goals.

No matter the size of your investment accounts, you can take advantage of personalized customer service and exceptional money management and advice. If you’ve been confused, overwhelmed or frustrated about how to maximize your wealth and your investments, let us show you a better way.

PERSONALIZED ATTENTION

Our strategies and investment selections continually align to meet your personal goals.

EXCEPTIONAL EXPERTISE

Our expertise spans over 40 years, allowing us to provide exceptional investment management and advice.

EMPATHETIC SUPPORT

As a founder-CEO firm, we understand the importance of your perspective.

Responsible Asset Management is an investment advisory firm founded in 1997 to serve individuals, families, small businesses and institutions. As a fee-only Registered Investment Advisor, not only are we held to the highest standard of fiduciary duty and commitment by law, our ideals are structured around, integrity, honesty and trust.

We believe that our strong code of ethics is fundamental in delivering exceptional investment management solutions to you.

Here's our process

STEP 1: Meet about your plan

We begin with a discovery meeting, an opportunity for both of us to get to know each other. You discover what we can do for you and we get to learn about you, your expectations and your goals. This meeting helps guide us toward a plan structure and strategy that helps to create a roadmap to achieve your financial goals.

STEP 2: CRAFT YOUR PLAN

We use your investment strategies, creating a custom risk profile to determine risk tolerance and return expectations. Plans align with one of our five distinct risk strategies: Very Conservative, Conservative, Moderate, Moderately Aggressive and Aggressive. Our proprietary Model Portfolio Strategies are selected and client specific Asset Allocations are recommended for investment portfolios.

STEP 3: MONITOR AND ADJUST

Our Corresponding Model Portfolio Strategies are reviewed on an ongoing basis and as changes are made with the models, the Asset Allocations within your investment portfolios are adjusted and realigned accordingly.

STEP 4: REPORT (and then repeat)

You will receive a Quarterly Report & Performance Review and are encouraged to meet with us regularly and as needed. We continually ascertain any additional information that may alter your Risk Profile.

Individual & Family Services

Individuals

Joint Tenants

Trusts

Estates

529 Plans

Education Savings

Traditional IRA

Roth IRA

Annuities

Life Insurance

Financial Planning

Estate Planning

SUSTAINABLE • RESPONSIBLE • IMPACT

INVESTMENT STRATEGIES

Your values help define you. Discover how you can align your investments with the things you care about, while you pursue your financial goals and make a positive impact through Sustainable Investing (ESG), Responsible Investing (SRI), and Impact Investing.

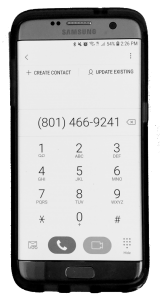

What's your next step?

Give us a call.

We believe in ensuring that we are a good fit for our clients. Our analysis process starts with a conversation in order to establish your financial needs and expectations. We then create an investment plan and strategy that puts you on a clear path to meet your investment goals.

Our Invest Right / Retire Right investment analysis targets three main areas:

- Client Assessment for Effective Investments

- Investment Strategy Formulation

- Custom Risk Profile Design

You’ll receive an in-depth report that evaluates your current investment portfolios and presents a proposed investment strategy which incorporates your risk profile and aligns with our proprietary Model Portfolio Strategies.

Contact us at 801-466-9241 to discover if our Invest Right / Retire Right plan analysis would benefit you.