RETIREMENT PLANS ALIGNED TO CORE VALUES

A well-defined retirement plan reflects your company’s goals and values and shows you care about your employees and their future.

You deserve confidence in knowing your company’s retirement plan is providing the very best opportunity for your employees to achieve success.

No matter what the size of your business, you shouldn’t miss out on personalized customer service for your organization’s retirement plan. If you’ve encountered a lack of empathy, automated responses and generic service for your plan management, let us show you a better way.

PERSONALIZED ATTENTION

Our strategies and investment selections continually align to meet your personal goals.

EXCEPTIONAL EXPERTISE

Our expertise spans over 40 years, allowing us to provide exceptional investment management and advice.

EMPATHETIC SUPPORT

As a founder-CEO firm, we understand the importance of your perspective.

Responsible Asset Management offers retirement plans that enhance your business’s participant and organizational success. Together, we carefully craft your plan to complement the needs and goals of your organization, so you can help your plan participants achieve successful retirement readiness.

As a co-fiduciary to your plan, we consistently adhere to the Fiduciary Rule and act only in the best interest of the plan and its participants.

Here's our process

STEP 1: MEET about your plan

You probably want to learn about what we can do for you and your organization. And we want to learn about your organization and your goals. This initial meeting helps guide us toward a plan structure that will complement your company’s framework and goals and maximize retirement readiness.

STEP 2: CRAFT YOUR PLAN

Next, we use our certified plan fiduciary advisor expertise to create a solid foundation for your plan governance, plan funding, and investment diversification (always structured around ERISA’s exclusive benefit rule). This includes sound plan charters, seamless administration practices and best-of-class investment choices.

STEP 3: MONITOR AND ADJUST

You can monitor your plan results with a real-time fiduciary monitoring platform. Meanwhile, we continuously analyze and monitor your employee retirement plan as it evolves, to keep it innovative and adaptable. Plan recordkeeping services are methodically selected to specifically work with your plan. Fiduciary monitoring platform provided by Fi360® Utilizing Fi360® and Morningstar® investment research, we help plan fiduciaries reduce their fiduciary liability.

STEP 4: REPORT (and then repeat)

Our reporting process is straightforward and transparent. We focus on keeping plan fiduciaries consistently informed with a comprehensive overview of plan governance, plan service providers, advisory services and plan investments.

Our Sponsor Services

Learn more about sponsor services by clicking on the items below.

We are an investment advice fiduciary to your plan. We provide investment advice and investment recommendations, specifically to the plan and its participants. We act for the exclusive benefit of the participants and beneficiaries of the plan. As a 3(21) we act as a plan “quarter back” helping facilitate all things necessary for the retirement plan.

Being a registered investment adviser under the Investment Advisers Act of 1940, we are bonded and have the investment management experience to act as an “Investment Manager” to the plan. We will act as a fiduciary to the plan and act exclusively for the benefit or the participants and beneficiaries. Acting as a 3(38) Investment Manager we manage plan assets on behalf of the plan. A 3(38) Investment Manager assumes all fiduciary liability for investment selection and monitoring of plan assets. Hiring a 3(38) Investment Manager offers plan sponsors protection against poor investment decisions.

A plan Investment Policy Statement is crafted to align plan investments with plan goals. Our Investment Policy Statements create a prudent process for managing your plan assets, while adhering to consistent fiduciary obligation requirements. Our IPS practices can also be incorporated into an existing retirement plan IPS.

Your fiduciary obligations and oversight are solidified with our plan fiduciary vault. All of your necessary plan documents are readily accessible through our online, secure, fiduciary vault. We meticulously update your vault with plan documents and monitoring reports, available to you at any time.

We create your retirement plans committee charter documents. We custom tailor and define your written process and structure your charter documents to work specifically for your company, while continuously meeting your fiduciary plan governance duty.

Our credentialed expertise allows us to offer proprietary Fiduciary Level Education, which is evident of prudent process by ERISA (Employee Retirement Income Security Act). We focus on the pillars of plan governance; Loyalty, Prudence, Diversification and Following Plan Governing Documents.

We focus on retirement savings behavior and engaging participants. Our education emphasizes real world practices and financial behavior that excites employees to invest early and to invest as often as they can.

We provide your employee retirement plan continuous fiduciary and investment monitoring. We work closely and partner with Fi360®, Morningstar® and your plan’s selected service providers to provide fluid monitoring and reporting services.

Fi360 Fee Benchmarker®, provides reliable fee bench marking for our plan sponsors. We take into account; scope of services, fee methods, plan type, type of service and plan details. All of which allow us to provide a true fee benchmarking service, helping to meet your fiduciary obligation for analyzing plan costs and value.

We selectively partner with plan record keeping and administrative services that align to meet your plan’s specific goals. Record keeping services include; website access to check account balances and make transfers, employee account statements, requesting trades and other transactions within employee accounts, producing enrollment and education materials, dedicated customer service lines.

The record keeper specifically selected for your retirement plan, provides our plan participants with a variety of education wellness tools to help keep plan participants retirement ready. We hand-pick record keepers that provide exceptional online educational tools to include; articles, videos, podcasts, booklets, retirement calculators, newsletters and more.

We custom create our own plan fiduciary, plan participant and plan investment newsletters. Our expertise allows to us create relevant original content for our clients and associates.

SUSTAINABLE • RESPONSIBLE • IMPACT

INVESTMENT STRATEGIES

Your values help define you. Discover how you can align your investments with the things you care about, while you pursue your financial goals and make a positive impact through Sustainable Investing (ESG), Responsible Investing (SRI), and Impact Investing.

Plans

Learn more about plan options by clicking on the items below.

A 401(k) plan is a qualified employer-sponsored retirement plan that eligible employees may make salary-deferral contributions to, on a post-tax and/or pretax basis.

A Solo 401(k) retirement plan covers a business owner with no employees, or that person and his or her spouse.

A 403(b) retirement plan is for specific employees of public schools, tax-exempt organizations and certain ministers.

A 457 retirement plan refers to a non-qualified, tax advantaged deferred compensation plan offered to state and local government employees.

A SIMPLE IRA (Savings Incentive Match Plan for Employees Individual Retirement Account) is a retirement plan used by small businesses with 100 or fewer employees.

A SEP IRA (Simplified Employee Pension Individual Retirement Account) is a retirement plan that an employer or self-employed individuals can establish.

A profit-sharing plan, also known as a deferred profit-sharing plan or DPSP, is a retirement plan that gives employees a share in the profits of a company. An employee can receive a percentage of a company’s profits based on its earnings.

A defined benefit retirement plan provides a benefit based on a fixed formula considering several factors, such as length of employment and salary history. The company administers portfolio management and investment risk.

A cash balance plan is a defined benefit retirement plan that maintains hypothetical individual employee accounts like a defined contribution plan. An employee accrues benefits according to a formula.

An employee stock option plan is a qualified defined-contribution plan designed to invest essentially in the sponsoring employer’s stock.

What's your next step?

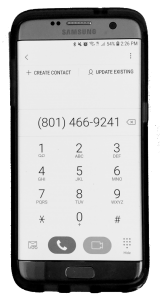

Give us a call.

We believe in ensuring a good fit for both of our organizations. Our process starts with a conversation between your company and ours, with that we’ll create an initial comprehensive plan analysis for your new or existing employee retirement plan. This initial discovery period is very beneficial in determining if our methods and values pair well with your organizational vision and goals.

Our Invest Right / Retire Right plan analysis targets three main support services for your plan:

- Plan Advisor Service

- Plan Record Keeping Service

- Plan Administrative Service

You’ll receive an in-depth overview and report that evaluates the following plan areas; documentation / features / governance / service agreements / reasonableness and accuracy of fees / compensation / investment diversification and performance / prudent Investment Policy Statement. This report is provided at no obligation to you.

Contact us at 801-466-9241 to discover if our Invest Right / Retire Right plan analysis would benefit your company.